Hidden among the tragic stories from Boston a week ago was a story that should probably have been on the front page. This story really grabbed my attention and has fundamental implications for the future of the planet and the structure and direction of the global economy. In a recent and fascinating piece of research, the group Carbon Tracker released a report highlight the implications of a global carbon emissions agreement, that minimizes the chance of a 2 degrees warming and essentially keeps fossil fuel reserves in the ground (as opposed to going up the pipe).

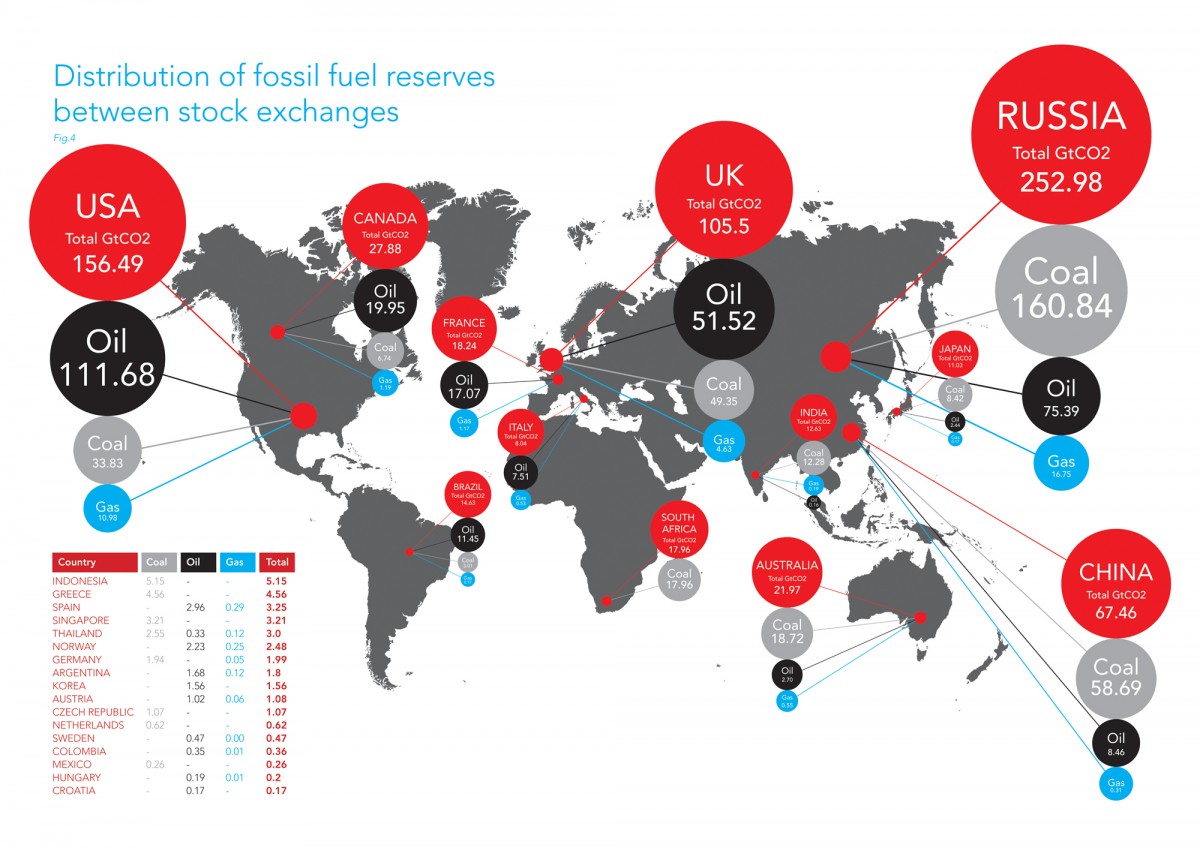

The idea of a 'carbon bubble' is the result of over valuing and investing in the exploration and exploitation of fossil fuel reserves (ie. coal, oil and gas). According to the report in 2011, the world has already used over a third of its 50-year carbon budget of 886 GtCO2. The report starkly calculates that the fossil fuel reserves owned by private industry and government equates to 2,860bn tonnes of carbon dioxide - well and truly over the safe amount of carbon that can be burned. Just 31% could be burned for an 80% chance of keeping below a 2C temperature rise. If we want to push the odds - for a 50% chance of 2C or less - just 38% could be burned. The message is here that 2/3 of fossil fuel reserves need to stay in the ground.

Up to $6tr of oil and gas assets could be left stranded over the next decade, throwing investments into disarray and potentially unleashing a new financial crisis - should international climate agreements hold firm. Fossil fuel companies are betting on the markets continuing to push for extraction and the failure of an international agreement to curb carbon pollution. We can see this by the investment figures... far from reducing efforts to develop fossil fuels, the top 200 companies spent $674bn in 2012 to find and exploit even more new resources, a sum equivalent to 1% of global GDP. Ironically the 2006 Stern review on the economics of climate change identified that 1% of GDP would fund the transition to a clean, green, renewable economy. It seems that despite the rhetoric - we are heading in the opposite direction.

Media reports from outlets such as the Guardian and BusinessGreen highlight the warning is supported by organisations including HSBC, Citi, Standard and Poor's and the International Energy Agency recognising that a collapse in the value of oil, gas and coal assets as nations tackle global warming is a major risk to the international economy. While the markets at present are living in a fantasy world, hedging bets on a continuation of infinite fossil fuel development and hence inflating the bubble, the likely future is one that will see massive loss of value for fossil fuel assets if a global agreement is reached in 2015. Investors are starting to see this as a risky investment choice... not only in terms of a loss of value as reserves will be locked up in the ground with an excessively overcaptialised industry; but also from the perspective of using said reserves will cook the planet and cause enormous impact on human civilization and the ecosystems that we depend on.

Investors need to act now and take the risk seriously and incorporate climate change and carbon risk into their investment strategies. This potential crisis could be avoided if renewable and cleaner alternatives are ramped up economy wide and to a scale equivalent to the capitalisation of the fossil fuel industry. This requires an enormous change and about face in the behavior of the markets, of investors, of governments and most importantly the public. While the threat of a new financial crisis is ominous... it is one that could be avoided since we have prior knowledge and recognition of the true costs. The choices are stark.... address climate change and bring in a financial crisis, or take the difficult step of investing in innovation across a low carbon economy... not in 50 years, not in 20 years... but now.

This potential crisis could be avoided if renewable and cleaner alternatives are ramped up economy wide and to a scale equivalent to the capitalisation of the fossil fuel industry. This requires an enormous change and about face in the behavior of the markets, of investors, of governments and most importantly the public. While the threat of a new financial crisis is ominous... https://twitter.com/1800Accountant

ReplyDelete